Final Days to Take Advantage of Section 179 for 2025

As 2025 comes to a close, medical practices, surgery centers, hospitals, and research labs have a limited window to slash their tax bills—potentially by hundreds of thousands of dollars—simply by investing in the equipment they already need. The IRS Section 179 deduction remains one of the most powerful tax incentives available to healthcare and laboratory businesses, and Auxo Medical is uniquely positioned to help you capture every dollar possible.

What Is Section 179 and Why It Matters in 2025

Section 179 allows businesses to deduct the full purchase price of qualifying equipment and software placed in service during the tax year, rather than depreciating it over many years. For 2025, the maximum Section 179 deduction is $2,500,000, with the phase-out threshold starting at $4,000,000 in total equipment purchases.

Translation: You can buy or finance the equipment you need anyway—and deduct up to $2.5 million immediately while reducing your taxable income dramatically.

Medical & Laboratory Equipment That Qualifies in 2025

Virtually every piece of capital equipment used in patient care, surgery, sterilization, or research qualifies. Popular categories Auxo Medical clients are deducting right now include:

- Anesthesia machines (GE, Mindray, Dräger)

- Surgical tables & lighting (Steris/AMSCO, Skytron, Hill-Rom)

- Sterilizers & autoclaves (Steris/AMSCO, Tuttnauer, Primus)

- Ultrasound machines (GE, Philips, Siemens)

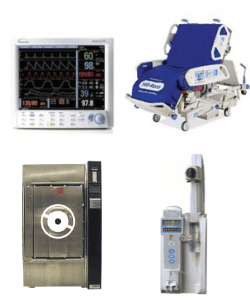

- Patient monitors & vital signs monitors

- Electrosurgical units & smoke evacuators

- Endoscopy/scopes & processing equipment

- Laboratory equipment (centrifuges, microscopes, incubators)

- Biomedical & infusion pumps

- Blanket & fluid warmers

- Stretchers, exam tables, and procedure chairs

Both new and refurbished equipment qualify equally under Section 179—the IRS makes no distinction as long as it’s placed into service in 2025.

Why Auxo Medical Is the Smart Choice for Section 179 Purchases

- Largest Inventory of Refurbished Name-Brand Equipment

Auxo maintains over 1,000 pieces of fully refurbished equipment from every major manufacturer—Steris, GE, Skytron, Mindray, Hill-Rom, Philips, Dräger, and more. You’re not limited to whatever happens to be in stock at the OEM. - Up to 70% Below OEM Pricing

Identical or better clinical performance at a fraction of the cost means you can acquire more equipment within the $2.5M deduction limit. - Same-as-New Warranty & Certification

Every piece undergoes a rigorous inspection and refurbishment process. You receive a full parts & labor warranty—typically 6 months to multi-year depending on the item. - Immediate Availability & Fast Delivery

Select equipment ships within days, not months. Perfect for hitting the December 31, 2025 “placed in service” deadline. - Financing That Preserves Your Deduction

Equipment financed through Section 179-qualified leasing or loans still qualifies for the full deduction in 2025.

Act Before December 31, 2025

The equipment must be purchased (or financed) and placed into service by midnight on December 31, 2025 to claim the full 2025 deduction.

Auxo Medical’s team is standing by to help you build the perfect Section 179 package—whether you need one surgical table or an entire OR/SPD renovation.

Call 888-728-8448 today or request a custom quote online and lock in 2025 pricing before it’s gone.

Maximize your deduction. Upgrade your facility. Save tens—or hundreds—of thousands in taxes.

Do it all before the ball drops.

-

*Featured (67)

-

AEDs (11)

-

Anesthesia Machines (23)

-

Anesthesia Monitors (15)

-

Anesthesia/Equipment Booms (6)

-

Autoclaves (57)

-

Bladder Scanners (5)

-

Blood Analyzers (1)

-

Boilers & Steam Generators (55)

-

C-Arms (46)

-

Carts / Transport (14)

-

Centrifuges (25)

-

Communications (1)

-

Defibrillators (11)

-

ECG (17)

-

Electrosurgical Units (38)

-

ENT (3)

-

Exam Tables & Chairs (102)

-

Fetal Monitors (12)

-

Flexible and Rigid Scopes (31)

-

Hospital Beds (17)

-

Hospital Grade Power Strips (3)

-

Infusion and Syringe Pumps (45)

-

Laryngoscopes (5)

-

Liposuction (12)

-

Microscopes (12)

-

Nanoseptic (4)

-

Patient Monitors (122)

-

Patient Positioning (35)

-

PPE (7)

-

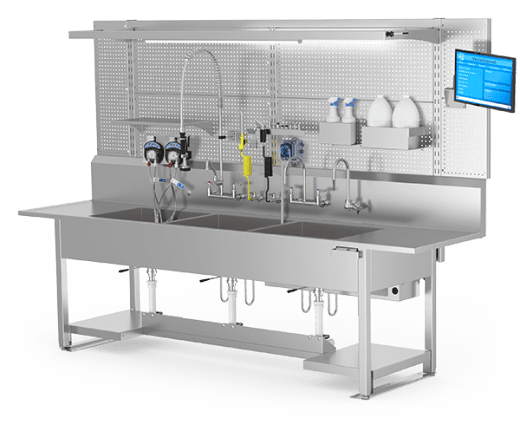

Processing Sinks (12)

-

Refrigerators / Freezers (23)

-

Rentals (72)

-

Scrub Sinks (10)

-

Stainless OR Suite Furniture (41)

-

Sterile Processing Equipment Repair Parts (76)

-

Sterile Processing Supplies & Accessories (35)

-

Sterilizers (49)

-

Stools / Task Seating (13)

-

Storage / Drying Cabinets (31)

-

Stretchers (88)

-

Suction and Oxygen Therapy (6)

-

Surgical Lighting (63)

-

Surgical Power Equipment (26)

-

Surgical Tables (65)

-

Temperature Monitoring (2)

-

Tourniquets (10)

-

Ultrasonic Cleaners (28)

-

Ultrasound Machines (76)

-

Ultraviolet Sanitation Products (63)

-

Vaporizers (10)

-

Vein Viewers (2)

-

Ventilators (25)

-

Warming Cabinets (43)

-

Washer Detergent (4)

-

Washer Disinfectors (39)

-

Wheelchairs (4)

-

Wound Management/Skin Graft (1)

-

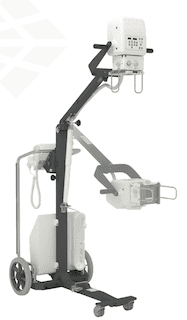

X-Ray (10)

As discussed in our Auxo Medical blog earlier this month, the Section 179 Tax Deduction is intended to motivate businesses to stay competitive by purchasing needed equipment, and writing off the full amount on their taxes for the existing year. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

As discussed in our Auxo Medical blog earlier this month, the Section 179 Tax Deduction is intended to motivate businesses to stay competitive by purchasing needed equipment, and writing off the full amount on their taxes for the existing year. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.