Maximizing Section 179 Tax Deductions with Medical and Lab Equipment from Auxo Medical

For the tax year 2025, the IRS has increased the maximum Section 179 deduction to $2,500,000. This means businesses can deduct up to $2.5 million of the cost of qualifying equipment purchased and placed into service by December 31, 2025. This increase aims to foster continued investment in vital medical equipment, especially in a competitive healthcare landscape.

Spending Caps and Phase-Out Thresholds

While the deduction limit has increased, it is important to be aware of the overall spending cap on qualifying equipment. The total amount of equipment purchased that can be fully deducted is $4,000,000. Once your total qualifying equipment purchases exceed this threshold, the deduction starts to phase out dollar-for-dollar.

This means that if your equipment purchases surpass $4 million, your deductible amount will reduce proportionally, emphasizing the importance of planning your investments within the deduction limits to maximize savings.

The Advantage of Immediate Deduction

One of the most attractive features of Section 179 is the ability to immediately expense the full cost of equipment, rather than spreading deductions over multiple years through depreciation. This benefit translates into substantial tax savings in the current fiscal year, freeing up capital for further investments or operational needs.

Use of the Section 179 Tax Calculator

To help businesses estimate potential savings, Auxo Medical recommends utilizing Ascentium Capital’s Section 179 Tax Calculator. This online tool provides an estimate of how much a healthcare practice or business could save by leveraging this tax advantage based on specific purchase amounts and financing options.

Types of Medical and Lab Equipment Eligible for Section 179

Auxo Medical offers a wide selection of medical and laboratory equipment that qualifies for the Section 179 deduction. Investing in these products not only enhances patient care but also provides significant tax benefits. Here is a detailed look at some of the most popular equipment categories eligible for this deduction:

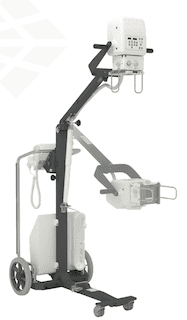

Imaging Equipment

High-quality imaging devices are crucial for accurate diagnosis and minimally invasive procedures. Auxo Medical offers:

- OEC 9900 C-Arm (Model: AM-OEC9900)

- Hologic Floroscan InSight FD Mini C-arm (Model: AM-INSIGHT-FD)

These C-arms are designed to deliver exceptional imaging clarity, helping healthcare professionals perform precise diagnostics and interventions.

Sterilization Equipment

Maintaining a sterile environment is vital for patient safety. Auxo Medical provides:

- Steris 400 Series 20″ Sterilizer (Model: AM-400-20)

- Steris 400 Series 48″ House Steam Sterilizer Recessed (Model: AM-400-48)

These sterilizers ensure that surgical instruments and supplies are contamination-free, supporting infection control protocols.

Surgical Tables

Versatile and sturdy surgical tables are essential in any operating room. Auxo Medical offers:

- Steris 4085 General Surgical Table (Model: AM-S4085)

- Oakworks CFPM400 Integrated Headrest Imaging-Pain Management Table (Model: AM-81808)

These tables provide stability and flexibility, accommodating a wide range of surgical procedures.

Surgical Lighting

Proper illumination enhances visibility and precision during surgeries. Auxo Medical stocks:

- Steris Harmony Air M Series Dual Head LED Surgical Light (Model: AM-HARMONYAIR-M-2L)

- Skytron Aurora LED 2 Head Surgical Light System (Model: AM-SKY-AURORA-2L)

These lighting systems offer shadow-free, bright illumination, critical for successful surgical outcomes.

Stretchers and Patient Transport Equipment

Transporting patients safely and comfortably is fundamental. Available options include:

- Stryker M Series Model 1015 Stretcher with Big Wheel (Model: AM-SM204B)

- Hill-rom P8000 Trauma/Procedure 700lb Stretcher (Model: AM-P8000-PS)

Designed for durability and ease of use, these stretchers ensure patient safety and staff efficiency.

Anesthesia Machines

Reliable anesthesia delivery is critical for surgical safety. Auxo Medical offers:

- Mindray A4 Advantage Anesthesia System (Model: AM-MINDRAY-A4)

- GE Avance CS2 Anesthesia Machine (Model: AM-GE-AVANCE-CS2)

Advanced features in these systems contribute to better anesthesia management and patient safety.

Ultrasound Systems for Nerve Blocks and Diagnostics

Ultrasound imaging is indispensable for diagnostics and nerve blocks. Options include:

- Chison SonoAir 70 with One Standard Transducer and Trolley (Model: AM-CHISON-SA70-1P-C)

- Mindray TE5 Ultrasound with 1 Probe (Model: AM-TE5-1P)

High-resolution imaging capabilities make these systems valuable in various medical specialties.

Surgical Microscopes

Precision surgery often requires high-quality microscopes. Auxo Medical offers:

- Leica M520 w/ OH3 Base Multidisciplinary Microscope (Model: AM-LEICAM520-OH3)

- Zeiss Opmi Pico Microscope (Model: AM-ZEISS-OPMI-PICO)

These microscopes deliver unparalleled clarity for detailed surgical work.

Refrigeration and Storage

Proper storage of medications and biological samples is critical. Equipment includes:

- Accucold 49 Cu.Ft. Upright Pharmacy Freezer (Model: AM-AFS49ML)

- Accucold 24″ Wide Stacked Combination Refrigerator/Freezer (Model: AM-FF7LW-VT65MLSTACKMED2)

Reliable refrigeration ensures sample integrity and compliance with storage standards.

Additional Savings with Auxo Medical’s Service Agreements

Beyond the immediate tax benefits, Auxo Medical offers additional savings through its service agreements. Customers with active service contracts receive a 5% discount on equipment purchases. This not only reduces upfront costs but also ensures ongoing maintenance and support, prolonging the lifespan and performance of your medical equipment.

How Service Agreements Enhance Your Investment

Service agreements include regular maintenance, calibration, repairs, and technical support, helping you avoid costly downtimes and ensuring your equipment operates at peak efficiency. Combining this with Section 179 deductions maximizes your overall savings, making healthcare investments more affordable.

For more details, contact Auxo Medical at 804.233.4424 or 888.728.8448 to learn about available service options and how they can benefit your practice.

How to Maximize Your Section 179 Deduction

To fully capitalize on the Section 179 tax deduction, it’s crucial to act before the deadline—December 31, 2025. Here are the steps to ensure you don’t miss this opportunity:

1. Consult Your Tax Professional

Before purchasing, consult your tax advisor to understand how Section 179 applies to your specific situation. They can help you strategize the best way to maximize deductions and ensure compliance with IRS regulations.

2. Select Your Equipment

Browse Auxo Medical’s extensive inventory of qualifying medical and lab equipment. Whether you need imaging systems, sterilizers, surgical tables, or anesthesia machines, choose the equipment that best suits your facility’s needs.

3. Arrange Financing or Purchase

Auxo Medical offers flexible financing options through Ascentium Capital, making it easier to acquire high-quality equipment without straining your budget. Whether buying outright or financing, ensure the equipment is purchased and financed within the current tax year.

4. Ensure Equipment is Installed and Operational

To qualify for the deduction, the equipment must be placed into service—that is, installed and operational—by December 31, 2025. Coordinate with your vendors and contractors to meet this deadline.

5. Use the Section 179 Tax Calculator

Estimate your potential savings by utilizing Ascentium Capital’s Section 179 Tax Calculator. This tool helps you understand the tax benefits based on your purchase amount and financing plan.

6. Make Your Purchase and Complete Installation

Once you’ve selected your equipment and secured financing, proceed with the purchase from Auxo Medical. Ensure the equipment is installed and ready for use before year-end to qualify for the deduction.

Why Choose Auxo Medical?

Auxo Medical has a proven track record of providing top-quality medical and laboratory equipment, along with exceptional customer service. Their extensive inventory includes both new and refurbished equipment, offering options to fit various budget levels. Additionally, their team provides expert consultation, maintenance, and repair services, ensuring your equipment remains in optimal condition.

By partnering with Auxo Medical, healthcare providers can confidently navigate the complexities of equipment procurement and tax benefits, making strategic investments that enhance patient care while reducing tax liabilities.

-

*Featured (67)

-

AEDs (11)

-

Anesthesia Machines (23)

-

Anesthesia Monitors (15)

-

Anesthesia/Equipment Booms (6)

-

Autoclaves (57)

-

Bladder Scanners (5)

-

Blood Analyzers (1)

-

Boilers & Steam Generators (55)

-

C-Arms (46)

-

Carts / Transport (14)

-

Centrifuges (25)

-

Communications (1)

-

Defibrillators (11)

-

ECG (17)

-

Electrosurgical Units (38)

-

ENT (3)

-

Exam Tables & Chairs (102)

-

Fetal Monitors (12)

-

Flexible and Rigid Scopes (31)

-

Hospital Beds (17)

-

Hospital Grade Power Strips (3)

-

Infusion and Syringe Pumps (45)

-

Laryngoscopes (5)

-

Liposuction (12)

-

Microscopes (12)

-

Nanoseptic (4)

-

Patient Monitors (122)

-

Patient Positioning (35)

-

PPE (7)

-

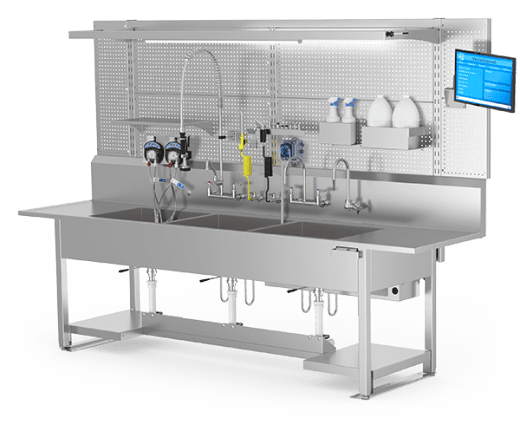

Processing Sinks (12)

-

Refrigerators / Freezers (23)

-

Rentals (72)

-

Scrub Sinks (10)

-

Stainless OR Suite Furniture (41)

-

Sterile Processing Equipment Repair Parts (76)

-

Sterile Processing Supplies & Accessories (35)

-

Sterilizers (49)

-

Stools / Task Seating (13)

-

Storage / Drying Cabinets (31)

-

Stretchers (88)

-

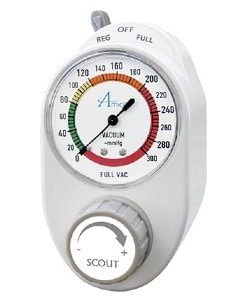

Suction and Oxygen Therapy (6)

-

Surgical Lighting (63)

-

Surgical Power Equipment (26)

-

Surgical Tables (65)

-

Temperature Monitoring (2)

-

Tourniquets (10)

-

Ultrasonic Cleaners (28)

-

Ultrasound Machines (76)

-

Ultraviolet Sanitation Products (63)

-

Vaporizers (10)

-

Vein Viewers (2)

-

Ventilators (25)

-

Warming Cabinets (43)

-

Washer Detergent (4)

-

Washer Disinfectors (39)

-

Wheelchairs (4)

-

Wound Management/Skin Graft (1)

-

X-Ray (10)