Medical Imaging Equipment Service and Repair by Auxo Medical

Medical imaging equipment such as C-Arms, radiography/fluoroscopy rooms, catheterization labs, and portable X-ray systems play a crucial role in diagnostics and patient care. At Auxo Medical, we understand the importance of maintaining these systems to ensure optimal performance and patient safety. With our expanded Imaging Equipment Field Service throughout the Mid-Atlantic region, we are dedicated to providing exceptional service and support tailored to the needs of healthcare facilities.

The Importance of Imaging Equipment Maintenance

Imaging equipment is a significant investment for healthcare providers, and its proper functioning is vital for delivering high-quality patient care. Regular maintenance and timely repairs can prevent unexpected breakdowns and costly downtime. Equipment failures can lead to delays in diagnosis and treatment, affecting patient outcomes and operational efficiency.

Key Benefits of Regular Imaging Equipment Service

- Enhanced Patient Safety: Properly maintained imaging systems minimize the risk of malfunctions that could jeopardize patient safety. Regular inspections and services ensure that safety features are operational and that equipment is calibrated correctly.

- Improved Image Quality: Degraded image quality can result from worn components or improper calibration. Regular maintenance helps ensure that imaging systems produce clear, accurate images essential for effective diagnosis.

- Cost Savings: Investing in regular maintenance can save healthcare facilities significant costs in the long run. By preventing major breakdowns and extending the lifespan of equipment, facilities can avoid expensive repairs and replacements.

- Compliance with Regulatory Standards: Maintaining imaging equipment is essential for meeting regulatory standards set by organizations like the FDA and state health departments. Regular inspections and documentation help ensure compliance and facilitate smooth audits.

Our Imaging Equipment Services

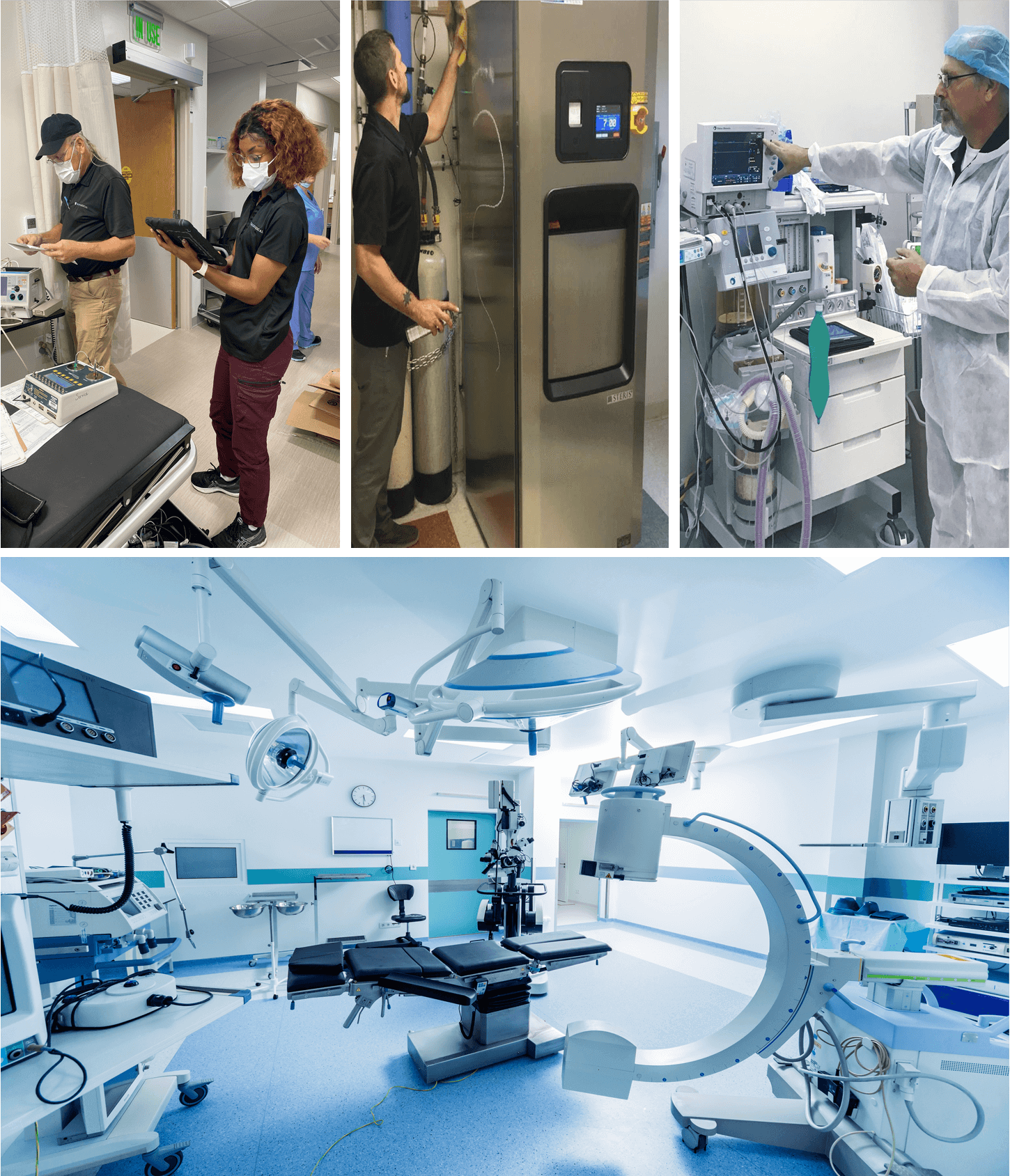

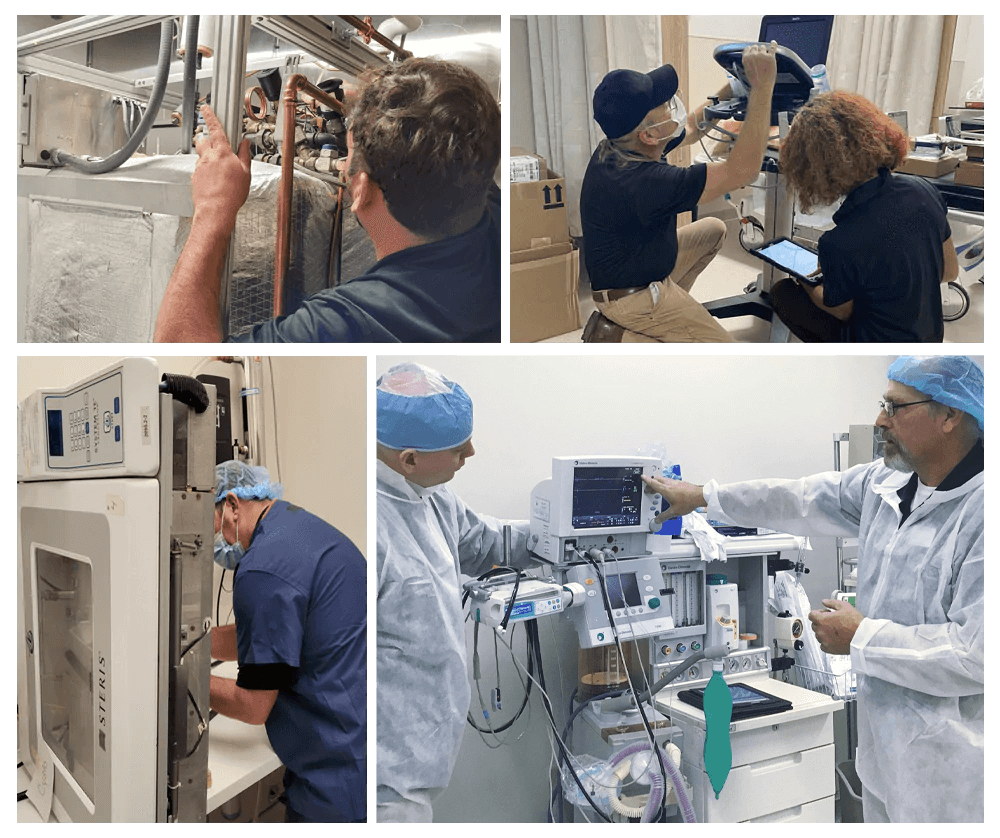

At Auxo Medical, we offer a comprehensive range of services for imaging equipment, tailored to meet the unique needs of various healthcare settings. Our experienced field service engineers are equipped to handle everything from routine inspections to complex repairs.

1. Equipment Inspections

Our imaging equipment inspections are thorough and designed to identify potential issues before they escalate. Key components of our inspection services include:

- Visual Inspections: Our engineers examine equipment for any physical damage, including wear on cables and connectors.

- Functionality Tests: We verify that all controls operate correctly and test the movement of the equipment for smooth operation.

- Image Quality Assessment: Using phantoms, we conduct tests to check for proper image contrast and resolution.

- Calibration Checks: Ensuring that systems are calibrated to manufacturer specifications is crucial for accurate imaging.

- Safety Features Verification: We check that safety interlocks and emergency stop functions are operational, ensuring patient safety during procedures.

- Electrical Safety Tests: We perform tests to check for proper grounding and leakage current, helping to prevent electrical hazards.

2. Repair Services

When issues arise, our team is ready to respond quickly with effective repair services. Our capabilities include:

- Component Diagnosis: We conduct thorough diagnostics to identify faulty components, such as X-ray tubes and detectors.

- Electrical Repairs: Our engineers can repair or replace damaged wiring, connectors, and circuit boards.

- Mechanical Repairs: This may include lubricating and repair of moving parts, ensuring proper alignment for optimal performance.

- Image Processing Repairs: Our team can troubleshoot software issues affecting image quality, as well as replace damaged imaging sensors.

- Calibration and Testing: Following repairs, we recalibrate systems and conduct image quality tests to verify improvements.

- Safety Feature Restoration: We ensure that all safety features function correctly after repairs.

3. Equipment De-installation and Relocation

As healthcare facilities grow and evolve, equipment may need to be relocated for various reasons:

- Facility Renovation: Our team assists with relocating imaging equipment during upgrades or remodeling.

- New Equipment Acquisition: When replacing outdated machines, we can safely de-install existing systems.

- Change in Clinical Workflow: Adjustments to patient flow may necessitate relocating equipment to improve efficiency.

- Expansion of Services: Opening new departments may require moving imaging systems to support expanded services.

- Space Optimization: Reconfiguring space for better utilization often involves relocating equipment to more strategic locations.

4. PACS and DICOM Troubleshooting

Auxo Medical also offers specialized support for PACS (Picture Archiving and Communication System) and DICOM (Digital Imaging and Communications in Medicine) issues, including:

- Connectivity Issues: Our engineers ensure that network connections between imaging devices and PACS servers function correctly.

- Image Retrieval Problems: We resolve issues with image transfers and verify that images are correctly sent to the PACS from imaging modalities.

- User Access Issues: Our team verifies user credentials and permissions to ensure all necessary personnel can access the system without complications.

- Storage Concerns: We analyze storage space on the PACS server and ensure backup procedures are in place for archived images.

Why Choose Auxo Medical?

Expertise and Experience

With years of experience in the healthcare equipment service industry, Auxo Medical is a trusted partner for imaging equipment maintenance and repair. Our team of skilled engineers is knowledgeable about a wide range of imaging systems from leading manufacturers, including GE Healthcare, Siemens, Philips, and more.

Quick Turnaround Times

We understand that downtime can severely impact patient care. That’s why our field service engineers are are centrally located, enabling us to provide rapid assessments and prompt repairs. Our commitment to timely service ensures that healthcare providers can maintain optimal functionality and prioritize quality patient care.

Cost Efficiency

Auxo Medical offers competitive pricing, allowing healthcare facilities to save up to 40%-50% off original equipment manufacturer (OEM) labor pricing. Our bundled service contracts for biomedical, sterile processing, anesthesia, and imaging equipment streamline maintenance processes while maximizing cost savings.

24/7 Emergency Services

Equipment malfunctions can occur at any time, which is why Auxo Medical provides 24/7 emergency repair services, 365 days a year. Whether it’s a late-night issue or a weekend breakdown, our expert engineers are ready to respond quickly and efficiently.

Trust Auxo Medical as you Medical Imaging Equipment Service Engineers

Maintaining the functionality and reliability of imaging equipment is crucial for delivering high-quality healthcare. Auxo Medical is here to support healthcare facilities throughout the Mid-Atlantic region with comprehensive imaging equipment service and repair solutions. Our experienced team, quick response times, and commitment to excellence make us the ideal partner for all your imaging service needs.

For more information about our imaging equipment services or to request a service quote, visit Auxo Medical Imaging Services today or request your service quote by filling out the form below. Let us help you keep your imaging systems running smoothly, ensuring that you can focus on providing exceptional care to your patients.

The chair has a rotational base that rotates 180 degrees, allowing healthcare professionals to access patients easily without needing to reposition the chair.

The chair has a rotational base that rotates 180 degrees, allowing healthcare professionals to access patients easily without needing to reposition the chair.

At Auxo Medical, we provide comprehensive services to help you assess and extend the lifespan of your medical equipment. Here’s how we can support your facility:

At Auxo Medical, we provide comprehensive services to help you assess and extend the lifespan of your medical equipment. Here’s how we can support your facility:

Preventative Maintenance Plans

Preventative Maintenance Plans

Specialized Services Across Various Equipment Categories

Specialized Services Across Various Equipment Categories