Are you tired of dealing with constant breakdowns and unreliable sterilizer and washer disinfector equipment in your Sterile Processing Department (SPD)? Look no further! At Auxo Medical, we understand the importance of having fully functional and efficient equipment to ensure the safety and effectiveness of your healthcare facility. We specialize in providing top-notch repair services for sterilizers and washer disinfectors, helping SPDs across the country maintain a smooth operation.

When it comes to sterilizer and washer disinfector repairs, we know that time is of the essence. That’s why our team at Auxo Medical is committed to delivering fast and reliable solutions. With our extensive expertise and experience in the field, we have become a trusted name in autoclave repairs. Our dedicated technicians are well-versed in diagnosing issues, performing repairs with precision, and ensuring that your equipment meets all necessary industry standards.

Are you a busy Sterile Processing Department (SPD) in need of a reliable repair company?

Running a Sterile Processing Department (SPD) is no small task. With the critical responsibility of ensuring proper sterilization and disinfection of medical instruments, you understand the importance of having reliable equipment. However, even the most well-maintained sterilizers and washer disinfectors can encounter issues or breakdowns.

In such situations, finding a trustworthy repair company becomes paramount to keep your SPD running smoothly. This is where Auxo Medical comes in. With their extensive expertise and experience in autoclave and washer disinfector repairs, they are committed to providing top-notch service to meet your repair needs effectively and efficiently.

What can go wrong with your sterilizer and washer disinfector?

When it comes to the critical task of sterilizing and disinfecting medical equipment, the reliability of your sterilizer and washer disinfector is paramount. However, these essential pieces of equipment are not immune to issues that can disrupt the smooth operation of your Sterile Processing Department (SPD). From minor malfunctions to major breakdowns, a range of problems can arise, hindering the efficiency and productivity of your facility.

One common issue that can occur with sterilizers is a failure to reach or maintain appropriate temperatures. This could result in ineffective disinfection, putting patient safety at risk. Additionally, leakages in seals or valves may compromise the sterility of instruments, leading to cross-contamination concerns. Washer disinfectors may also encounter problems such as inadequate water pressure or malfunctioning sensors, which can impact their ability to properly clean and sanitize instruments.

The importance of a reliable sterilizer and washer disinfector in a SPD

A Sterile Processing Department (SPD) forms the backbone of any healthcare facility, ensuring that medical instruments and equipment are properly cleaned, sterilized, and ready for use. Within this crucial department, the role of a reliable sterilizer and washer disinfector cannot be overstated. These machines play a vital role in maintaining patient safety by effectively eliminating harmful bacteria, viruses, and other pathogens from instruments.

When it comes to patient care, there is no room for compromise. A reliable sterilizer ensures that contaminated instruments go through a thorough cleaning process before being subjected to high-pressure steam or chemicals for sterilization. Similarly, a dependable washer disinfector guarantees that surgical tools and equipment are thoroughly cleaned to remove organic debris before undergoing the final disinfection process.

Common issues and breakdowns that can occur with these equipment

Just like any other complex machinery, sterilizers and washer disinfectors are not immune to occasional malfunctions. These vital pieces of equipment play a crucial role in maintaining the highest standards of cleanliness and safety in healthcare facilities. However, they can encounter certain issues that may hamper their efficient operation.

One common issue that can arise with sterilizers is temperature deviations. Maintaining precise temperatures is essential for proper sterilization, and any deviation from the required range can compromise the effectiveness of the process. Additionally, issues with pressure sensors or faulty gaskets may lead to leakage problems, jeopardizing the integrity of the sterilization process.

When it comes to washer disinfectors, blockages in spray arms or clogged filters can disrupt the cleaning cycle. This might result in inadequate cleaning and residual contaminants on instruments or equipment surfaces. Moreover, malfunctions related to heating elements or water pumps can hinder proper drying, leading to moisture retention and potential microbial growth.

In order to ensure optimal performance of these critical machines, it is imperative to address these common breakdowns promptly and efficiently by relying on professional repair services provided by reputable companies like Auxo Medical.

Why Choose Auxo Medical for Your Repair Needs?

When it comes to entrusting the repair of your sterilizer and washer disinfector to a professional company, there are several compelling reasons why Auxo Medical stands out from the competition. With an unwavering commitment to excellence and decades of expertise in autoclave and washer disinfector repairs, Auxo Medical has earned a stellar reputation in the industry.

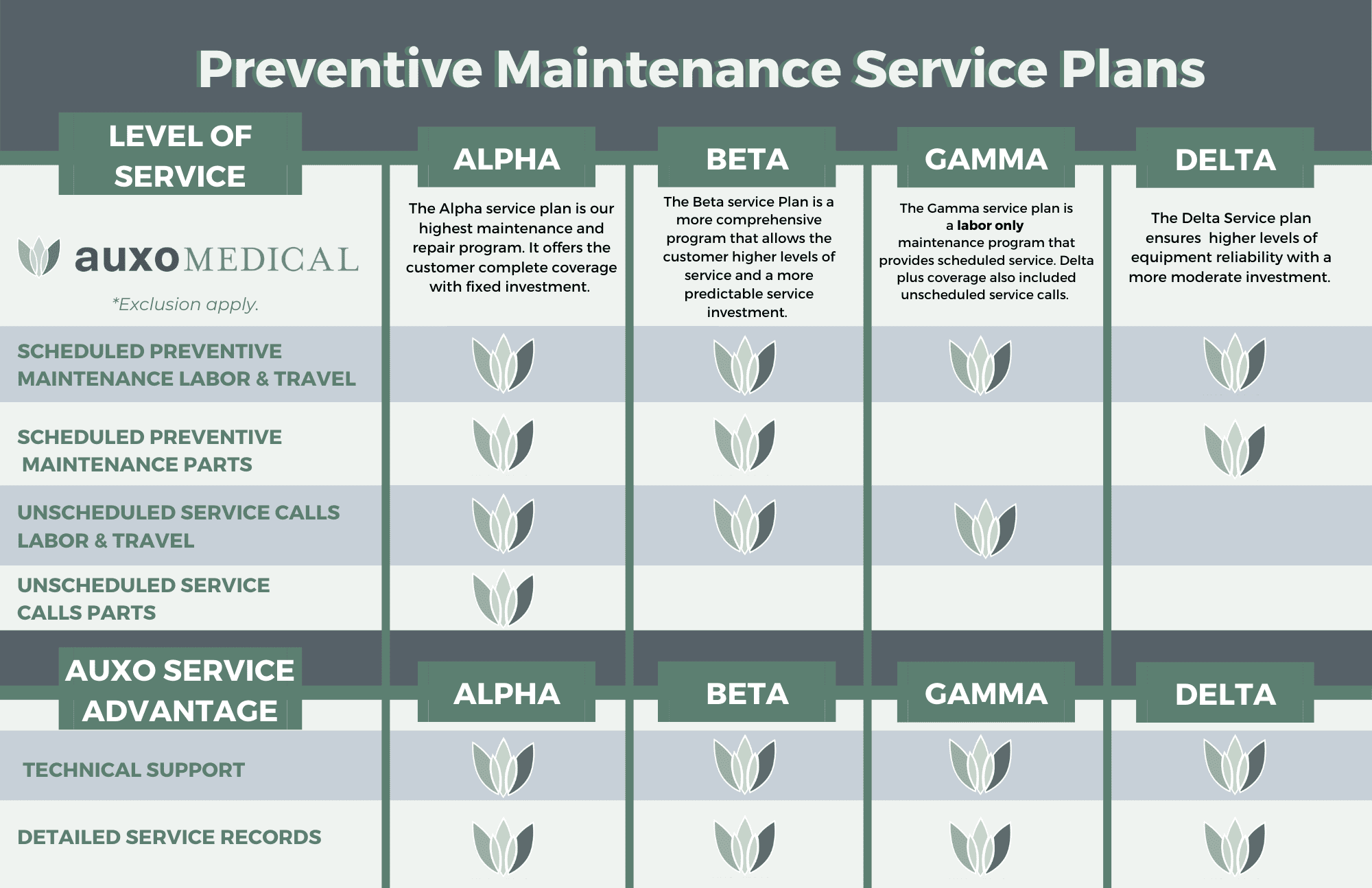

The team at Auxo Medical consists of highly skilled technicians who possess an intricate understanding of the inner workings of these critical pieces of equipment. They employ their extensive knowledge to diagnose issues accurately and efficiently, ensuring that your sterilizer or washer disinfector is back up and running in no time. The dedication to quality service extends beyond just repairs; Auxo Medical also offers comprehensive preventive maintenance plans tailored to meet your specific needs, guaranteeing the longevity and optimal performance of your equipment.

The expertise and experience of Auxo Medical in autoclave and washer disinfector repairs

Auxo Medical has established itself as a trusted name in the field of autoclave and washer disinfector repairs. With decades of experience, our team of highly skilled technicians possesses an extensive knowledge base that sets them apart from the competition. They understand the intricacies of these vital sterilization equipment, allowing them to diagnose and resolve issues with precision.

What truly distinguishes Auxo Medical is our commitment to staying updated with the latest advancements in sterilization technology. Our technicians regularly undergo training programs to enhance their skills and keep up with industry trends. This ongoing commitment ensures that they are always equipped to handle even the most complex repair tasks efficiently.

Testimonials from Satisfied Clients Who Have Relied on Auxo Medical for Their Repair Needs

When it comes to choosing a reliable sterilizer and washer disinfector repair company, the experiences of others can speak volumes. Countless satisfied clients have turned to Auxo Medical for their repair needs and have been impressed by the level of service they received.

“I have used auxo to service my sterilization equipment for 15+ years at two separate facilities. They have knowledge of our facility, engineering staff, as well as our equipment. Auxo provides education to my staff on our sterilization equipment. You’ll be rewarded with great customer service. During a renovation project, auxo used a creative approach to keep us up and running during the entire process.” – Carolyn H. , Sterile Processing & Distribution Manager

“The Auxo Medical team has been an outstanding partner. Their response to service calls has been stellar. We are very pleased with the management and tech support they provide.” – Mike G., Operations Manager

“Mr. Claude McGuire is a phenomenal technician that has always been accommodating, professional and expedient in his work of keeping our autoclaves online and good to go! I would recommend Auxo Medical and their maintenance contracts – hopefully you’ll get as lucky as we are to have Mr. McGuire service our sites.” – Grant McCormick

The Benefits of Preventive Maintenance Plans

Investing in a preventive maintenance plan for your sterilizer and washer disinfector is a wise decision that can provide numerous benefits for your Sterile Processing Department (SPD). By implementing regular maintenance procedures, you can ensure the longevity and optimal performance of your equipment, ultimately saving you time, money, and stress in the long run.

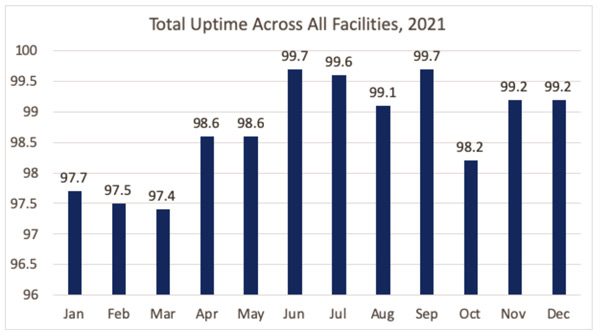

One of the key advantages of preventive maintenance is the ability to identify potential issues before they become major problems. Through routine inspections, cleaning, and calibration, skilled technicians from Auxo Medical can detect any early signs of wear or malfunction in your sterilizer or washer disinfector. By addressing these minor issues promptly, they can prevent costly breakdowns and extend the overall lifespan of your equipment. A well-maintained machine not only ensures uninterrupted workflow in your SPD but also contributes to increased efficiency and productivity.

Exploring the advantages of an ongoing preventive maintenance plan for your equipment

Investing in an ongoing preventive maintenance plan for your sterilizer and washer disinfector is a proactive approach that can yield numerous benefits. Firstly, regular inspections and servicing by highly trained technicians can help detect any potential issues before they escalate into major breakdowns. This not only saves you from costly repairs but also ensures uninterrupted operations in your Sterile Processing Department (SPD).

Moreover, a preventive maintenance plan helps extend the lifespan of your equipment. By conducting routine checks, cleaning, and calibration, your sterilizer and washer disinfector can function optimally for a longer period. This not only saves you money on premature replacements but also allows you to maximize the return on your investment.

How preventive maintenance can save you time, money, and stress in the long run

Imagine this scenario: You’re in the middle of a hectic day in your Sterile Processing Department (SPD), when suddenly your sterilizer or washer disinfector breaks down. Panic sets in as you scramble to find a repair technician, while valuable time ticks away and surgical procedures are delayed. Now, picture an alternative reality where regular preventive maintenance was implemented for your equipment.

In this ideal world, preventive maintenance becomes the cornerstone of your SPD’s operations. Skilled technicians from Auxo Medical meticulously inspect and service your sterilizer and washer disinfector on a routine basis. They identify potential issues before they become major problems, ensuring optimal performance and minimizing the risk of costly breakdowns. This proactive approach saves you precious time that would have been wasted on emergency repairs, allowing you to focus on delivering timely sterilized instruments to operating rooms.

Emergency repair services you can count on

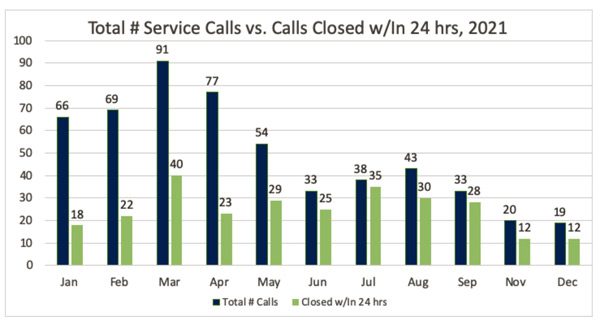

In the unfortunate event of a breakdown or malfunction in your sterilizer or washer disinfector, time is of the essence. This is where Auxo Medical’s exceptional emergency repair services come to your rescue. We understand the critical nature of your Sterile Processing Department’s operations, and we are committed to providing prompt and reliable repairs to minimize any downtime.

When you choose Auxo Medical for emergency repairs, you can rest assured that our team of highly skilled technicians will swiftly respond to your call. Equipped with extensive knowledge and expertise, they will diagnose the issue accurately and efficiently restore your equipment to its optimal functionality. With an Alpha level service plan, our commitment to providing exceptional service extends beyond regular business hours because we understand that emergencies can strike at any time. With Auxo Medical by your side, you can regain peace of mind knowing that we are available around the clock, ready to tackle any repair challenge that comes our way.

The peace of mind offered by Auxo Medical’s emergency repair services

In the demanding world of Sterile Processing Departments (SPD), unexpected breakdowns can cause tremendous stress and disruption. However, with Auxo Medical’s emergency repair services, you can find peace of mind knowing that help is just a phone call away. With an Alpha Level PM Plan, our team of highly skilled technicians is available 24/7 to promptly address any urgent repair needs.

When an unforeseen problem arises with your sterilizer or washer disinfector, time is of the essence. The efficiency and expertise of Auxo Medical’s emergency repair services ensure that your equipment will be assessed and repaired with utmost urgency. With our prompt response time and thorough understanding of SPD operations, you can rest assured that downtime will be minimized, allowing you to swiftly return to full productivity.

Immediate response and quick repairs to minimize downtime in your SPD

In the fast-paced world of healthcare, time is of the essence. When your sterilizer or washer disinfector malfunctions, every minute counts. That’s why Auxo Medical understands the urgency and provides immediate response and quick repairs to minimize downtime in your Sterile Processing Department (SPD).

Upon contacting Auxo Medical with a repair request, our team springs into action with unparalleled efficiency. Our experienced technicians are equipped with the knowledge and tools necessary to diagnose and address the issue promptly. Whether it’s a broken seal, malfunctioning control panel, or any other problem that may arise, Auxo Medical works diligently to restore your equipment to optimal functioning in the shortest possible time.

More than just repairs: additional services provided by Auxo Medical

Auxo Medical understands that a reliable sterilizer and washer disinfector are just the beginning of your needs in a Sterile Processing Department (SPD). That’s why we go above and beyond by offering a range of additional services to support your facility. One such service is their expertise in boiler and steam generator repairs.

Boilers and steam generators are crucial components in the sterilization process, and any malfunction can disrupt your SPD’s operations. With Auxo Medical, you can rest easy knowing that their skilled technicians are well-versed in repairing these vital systems. Whether it’s addressing leaks, optimizing performance, or conducting routine maintenance, Auxo Medical provides comprehensive solutions to keep your entire sterilization infrastructure running smoothly.

Exploring the additional offerings of Auxo Medical, such as boiler and steam generator repairs

When it comes to ensuring the smooth operation of your Sterile Processing Department (SPD), it’s not just about sterilizers and washer disinfectors. That’s why Auxo Medical goes above and beyond by offering reliable boiler and steam generator repairs.

Boilers and steam generators play a crucial role in maintaining optimal sterilization conditions. However, they can also encounter issues that require immediate attention. With their team of highly skilled technicians, Auxo Medical is equipped to handle any boiler or steam generator repair with precision and efficiency. From diagnosing the problem to providing expert solutions, they are dedicated to getting your equipment back up and running in no time.

The convenience and comprehensive service provided by Auxo Medical for all your SPD needs

Auxo Medical not only offers reliable repairs for your sterilizer and washer disinfector, but we also provide a wide range of comprehensive services to fulfill all the needs of your Sterile Processing Department (SPD). With our commitment to excellence and attention to detail, Auxo Medical ensures that every aspect of your SPD operations is taken care of.

From equipment purchases, installations and maintenance to technical support and staff training, Auxo Medical goes above and beyond to provide a holistic approach to SPD management. Our team of highly skilled technicians is not only proficient in repairing sterilizers and washer disinfectors but also well-versed in the intricacies of other critical equipment used in SPDs. Whether it’s steam generators, autoclaves, washer disinfectors or boilers, you can rely on Auxo Medical to handle it all.

Ensure the reliability of your sterilizers, autoclave, washer disinfector and steam generators with Auxo Medical

When it comes to maintaining a sterile processing environment, the reliability of your SPD equipment is paramount. By choosing Auxo Medical for all your maintenance and repair needs, you are taking a proactive step towards safeguarding the efficiency and functionality of these crucial devices. With our exceptional expertise and decades of experience in autoclave and washer disinfector repairs, Auxo Medical stands as a trusted partner for ensuring that your equipment operates at peak performance. Contact Auxo Medical today to set up a comprehensive Preventive Maintenance Plan today! Call toll-free (888) 728-8448.

he Midmark M9 Ultraclave is a cutting-edge autoclave that revolutionizes sterilization in healthcare settings. Built with precision and innovation, this state-of-the-art machine ensures the highest level of safety and efficiency in sterilizing medical instruments and equipment. The Midmark M9 Ultraclave combines advanced technology with user-friendly features to streamline the sterilization process, saving valuable time for healthcare professionals.

he Midmark M9 Ultraclave is a cutting-edge autoclave that revolutionizes sterilization in healthcare settings. Built with precision and innovation, this state-of-the-art machine ensures the highest level of safety and efficiency in sterilizing medical instruments and equipment. The Midmark M9 Ultraclave combines advanced technology with user-friendly features to streamline the sterilization process, saving valuable time for healthcare professionals.